Are you looking for Safest Real Estate Investments? Well, you’ve worked hard to achieve financial success. Now it’s time to put your money to work for you. As an elite investor, you have access to exclusive investment opportunities with the potential for high returns. One avenue worth exploring is real estate syndication, where groups of investors pool funds to purchase and operate commercial properties. By investing in real estate syndications, you can benefit from the experience of seasoned real estate professionals and gain exposure to large, income-producing properties that would be difficult to acquire on your own.

The key is finding the right sponsors and deals that match your investment objectives. If you’re looking to diversify your portfolio, generate passive income, and achieve double-digit returns, real estate syndication could be an ideal vehicle to accelerate your wealth creation. The playbook for elite investors starts here.

Table of Contents

Why High-Rise Luxury Properties Are the Safest Real Estate Investments

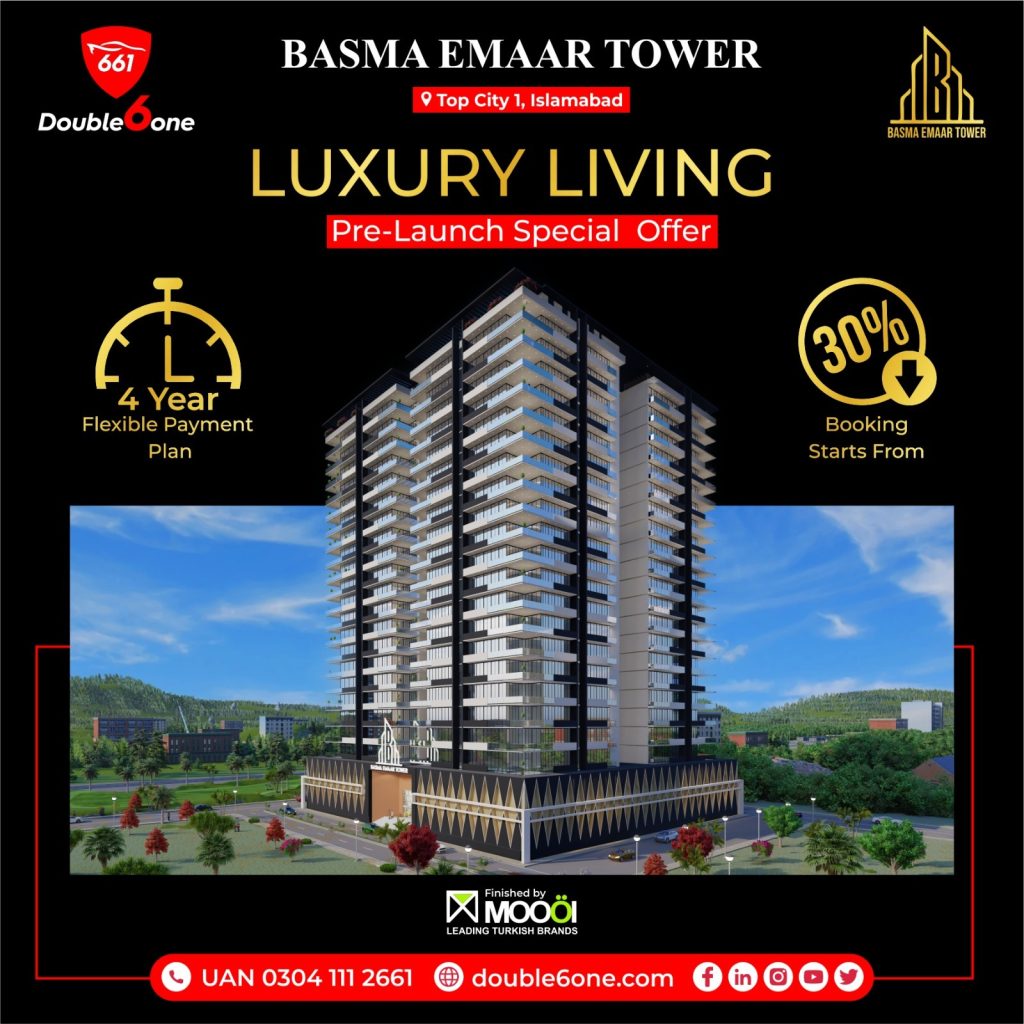

As an elite investor, your time and money are valuable. For the highest returns and lowest risks, high-rise luxury properties are the safest real estate investments. Basma Emaar Tower is pleased to fulfill your high dreams and your wish to have beautiful peaceful home.

- Scarcity drives demand. There is a finite amount of space in desirable city centers and a growing number of high net worth individuals seeking premier properties. This imbalance results in price appreciation over time that outpaces inflation.

- Luxury amenities attract affluent tenants. Features like concierge services, gyms, pools, screening rooms and building events draw in clients willing and able to pay premium rents, leading to higher occupancy rates and rental income.

- Strict tenant vetting reduces risks. Rigorous background and credit checks are performed to ensure tenants are able to meet their obligations. This results in extremely low delinquency and default rates, protecting your investment.

- Brand prestige adds value. Well-known, prestigious developers are able to charge a premium for their buildings. This brand equity is passed onto investors and tenants, resulting in a property that holds its value better over market ups and downs.

- Prime locations offer stability. Luxury high-rises in the most coveted city addresses are less exposed to market fluctuations. These areas have consistently been desirable to the wealthy for generations and weather recessions well due to limited supply.

By purchasing a stake in a prestigious luxury high-rise in a prime location, you position yourself to generate substantial returns from a stable, secure asset. Work with specialized real estate brokers to find the premier investment that fits your portfolio and start taking advantage of the safest Real Estate Investments.

The 3 Keys to Identifying Prime Investment Opportunities

To capitalize on lucrative safest real estate investments, identifying prime opportunities is key. There are three essential factors to consider:

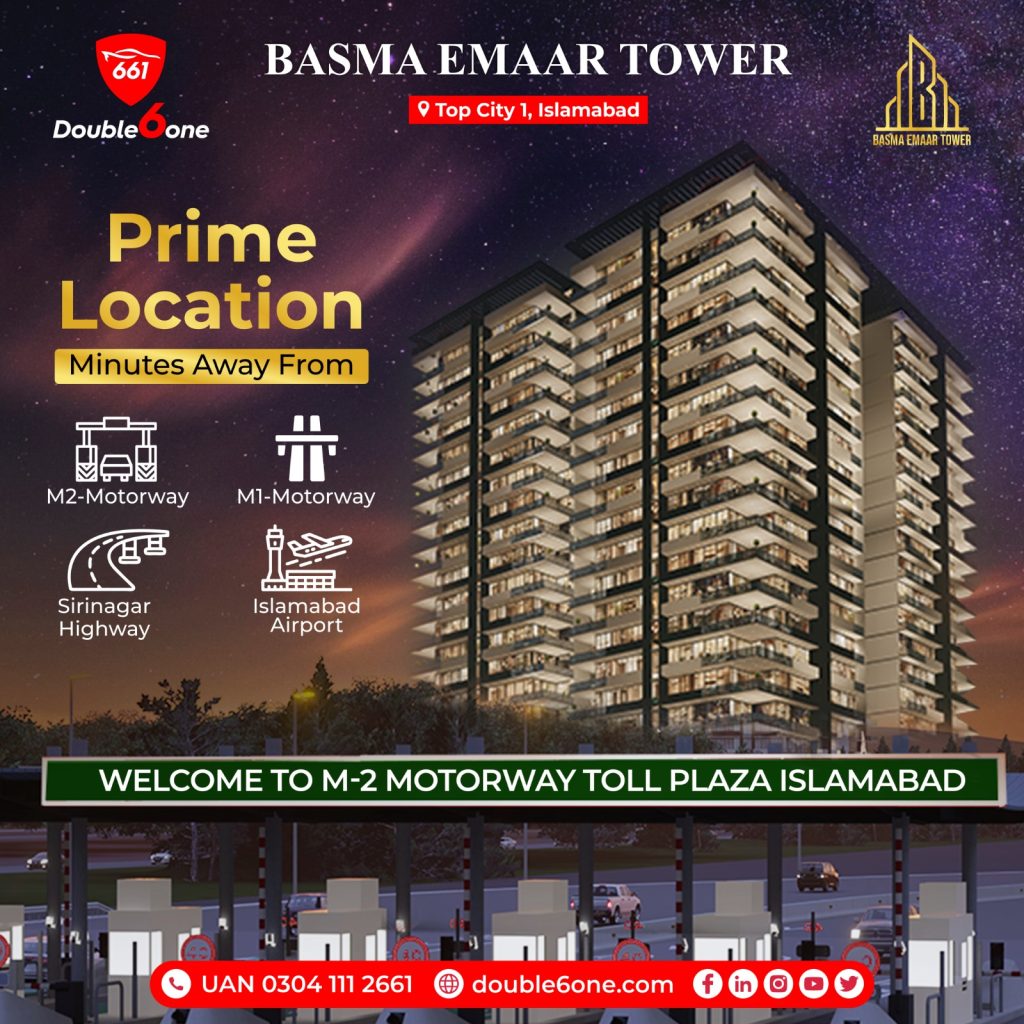

Location: Seek out properties in desirable, high-demand areas that attract affluent tenants and withstand market fluctuations. Look for central locations in business districts, near major transit lines, entertainment venues, healthcare facilities, and prestigious schools. Properties in scenic, natural settings or historic neighborhoods also hold significant appeal.

Building Quality: Focus on well-constructed, visually appealing buildings with luxury amenities and finishes that command top rental rates and high resale values. Modern steel and glass high-rises, elegantly renovated historic buildings, and eco-friendly structures are attractive options.

Financials: Analyze the investment potential by evaluating the property’s operating expenses, tax burden, financing terms, and projected returns. Look for solid cash flow, healthy cap rates, and opportunities for value-add improvements to increase rents. Review historic operating data and market reports to determine realistic income and appreciation projections.

By targeting premier locations, state-of-the-art buildings, and financially viable investments, you can build a high-quality real estate portfolio poised to generate substantial wealth over the long run. With in-depth research and experienced guidance, identifying the most promising opportunities becomes infinitely easier, allowing you to make shrewd acquisition decisions that yield the strongest returns. By following these keys, you’ll gain access to the most elite, lucrative and the safest Real Estate investments.

Negotiating the Best Deal: How to Get High-Rise Developers to Bargain

To negotiate the best deal with high-rise developers, you must approach the bargaining table from a position of strength. Do your research and determine the property’s fair market value so you know how much you can pay without compromising your expected return.

Conduct Due Diligence

Thoroughly analyze the building’s amenities, vacancy and turnover rates, operating expenses, and capital needs. Check if any major repairs or renovations are required in the next few years that could impact your cash flow. Review the leases of current tenants to understand the rental terms and rates. All of this will reveal the property’s investment potential and any risks you need to consider in your offer price.

Secure Financing

Obtain a preapproval letter from your lender to demonstrate you have funding in place. This way is one of the safest real Estate investments. This signals to the seller you are a serious, qualified buyer. Be prepared to put at least 20-25% down to make your offer more appealing.

Start Low and Hold Firm

Submit an initial offer at least 10-15% below the asking price. Don’t get emotional — remain detached from the outcome. Counter the seller’s responses with small incremental increases to reach a compromise, but stand by your limit. If you’ve set a maximum price based on your due diligence, don’t go above it. Walking away is better than overpaying.

Consider Incentives

Rather than raising your offer, suggest incentives that benefit both parties. For example, propose the seller pays for certain capital improvements or maintenance costs after closing or offers you a discount if you sign leases with anchor tenants they have lined up. You can also ask for a lower down payment with the seller providing part of the financing. Creative alternatives like these often prevail in the end.

Following these steps will put you in the strongest position to negotiate the best deal on a high-rise investment property. All these steps need to be followed so to make the safest real estate investments for your future. Do your homework, secure funding, start with a reasonable offer and stand firm, consider alternative incentives, and don’t be afraid to walk away if needed. With discipline and determination, you can get developers to bargain.

Financing Your High-Rise Investment Property the Smart Way

To finance a high-rise luxury investment property, you have several intelligent options to consider. Each have their own advantages and disadvantages, so evaluate them carefully based on your financial situation and investment goals.

Cash

Paying with cash is the simplest method, avoiding interest charges and loan fees. However, it requires significant capital upfront and reduces your cash on hand for other opportunities. Cash deals also typically need to close quickly, limiting your ability to negotiate the best price.

Conventional Mortgage

A conventional mortgage allows you to put 20-30% down while borrowing the remaining balance. Interest rates are usually reasonable, but you are responsible for principal and interest payments over a fixed term of 15-30 years. The long repayment period provides stability but reduces your cash flow for decades.

Interest-Only Mortgage

An interest-only mortgage is initially cheaper since you’re only paying the interest charges. Your payments rise substantially once the interest-only period ends and you start repaying the principal balance. This option gives you more cash flow upfront to put into the investment but risks the payments becoming unaffordable later on.

Equity Mortgage (Home Equity Line of Credit)

If you have equity in other real estate, an equity mortgage uses that as collateral for a mortgage. Interest rates are often lower, and terms are flexible. However, you put your other property at risk if you default on the mortgage. An equity mortgage should only be used for a stable, income-producing property to minimize risk.

Private Money

Private money refers to funding from private investors, often with higher interest rates and more stringent terms than a traditional mortgage. However, private money can close very quickly and is based more on the deal fundamentals than your personal credit or income. If the property cash flows well, the higher interest may be offset by a good return. Build a strong relationship with private money sources to have this financing option available when a good opportunity arises.

In summary, evaluate your financing options carefully based on your goals, risk tolerance, and the specifics of the property in question. The optimal approach is often a combination of methods, such as using cash or private money for a large down payment, then financing the remaining amount with a conventional or interest-only mortgage on terms that match your investment timeline. With the right financing strategy, you can maximize returns on your high-rise luxury property investments.

High-Rise Property Management: How to Maximize Returns and Minimize Headaches

Selecting the Right Property Manager

When investing in high-rise real estate, choosing an experienced property manager is essential to maximizing your returns while minimizing headaches. Look for a manager with at least 5-10 years of experience specifically managing luxury high-rise buildings. They should be well-versed in handling the unique challenges that come with overseeing a large residential tower.

Providing Luxury Amenities

Tenants renting apartments in upscale high-rises expect premium amenities. Work with your property manager to determine which facilities and services will attract high-quality tenants and command the highest rents, such as:

- A state-of-the-art fitness center with personal trainers available

- An infinity pool with panoramic city views

- A concierge to assist with tasks like booking theater tickets or making dinner reservations

- Valet parking and on-site charging stations for electric vehicles

- A rooftop lounge or garden terrace for entertaining

Optimizing Operating Costs

While luxury amenities are appealing to tenants, they also increase operating costs substantially. Basma Emaar Tower is taking great interest to provide the luxurious amenities to its residence, therefore the the investors will definitely feel that they have made truly safest real estate investments, Instruct your property manager to find ways to offset costs through energy efficiency upgrades like:

- Installing LED lighting, smart thermostats and low-flow water fixtures

- Using sustainable and recycled materials when renovating common areas

- Hiring staff with training in areas like preventative maintenance to minimize excess waste and repair costs

By keeping close tabs on utility usage and implementing green practices, operating costs can be reduced by up to 30% annually in some high-rises. These savings can then be passed onto tenants through lower rent increases or reinvested to enhance amenities.

With an experienced property manager, the right amenities, and cost-effective operations, your high-rise investment can generate healthy returns for years to come and will turn into the safest real estate investments. But never stop looking for ways to streamline processes, cut costs and improve the tenant experience. Continuous optimization and innovation are key to succeeding as an elite real estate investor.

Conclusion

Basma Emaar Tower is successfully gaining trust of its clients by providing safest real estate investments. As an elite investor, you understand that the safest real estate investments can be an extremely lucrative asset class if you know how to find the right opportunities. By focusing on value-add properties with high cash flow potential, negotiating the best possible deal terms, and maximizing value through strategic renovations and management, you put yourself in position to realize returns of 20-30% per year or more. While the strategies and concepts discussed here require significant capital, expertise, and risk tolerance, the rewards for those able to execute them successfully can be life-changing.

If you’re looking to build real, generational wealth and the safest real estate investments, this elite investor’s playbook provides the blueprint for how to make your money work for you at the highest levels. The only question that remains is whether you have the vision and determination to become a master of the game.